hotel tax calculator bc

Total purchase price means the total amount that a guest pays for the right to use the accommodation including any additional charges for extra beds cots cribs linens and pets but not including the goods and services tax GST. The following table provides the GST and HST provincial rates since July 1 2010.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Please enter a valid sale price select a sale type and select a. Sale Price or MSRP.

Please note that campsite and RV site rentals are exempt. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more units. State Hotel Tax applies statewide to all rental accommodations with 5 or more rooms.

22 Accommodation includes the provision of lodging in a lodging houses boarding houses rooming houses resorts bed and breakfast establishments and similar places. Sales taxes make up a significant portion of BCs budget. Who the supply is made to to learn.

- 5 Goods Services Tax GST levied by the federal government. - 7 Provincial Sales Tax PST levied by the province. 53 rows State has no general sales tax.

This bylaw may be cited for all purposes as City of Kelowna Hotel Tax Bylaw No. The City of Kelowna Additional Hotel Room Tax Bylaw No. Where the supply is made learn about the place of supply rules.

Any exemptions or additional property transfer tax ie. For a summary of the changes see Latest Revision at the end of this document. Foreign buyer will show if applicable to help calculate your costs of buying a home in BC.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary. The rate you will charge depends on different factors see.

Current BC personal tax rates in British Columbia and federal tax rates are listed below and check. 7 State sales tax on lodging is lowered to 50. 10015 and all amendments thereto are hereby repealed.

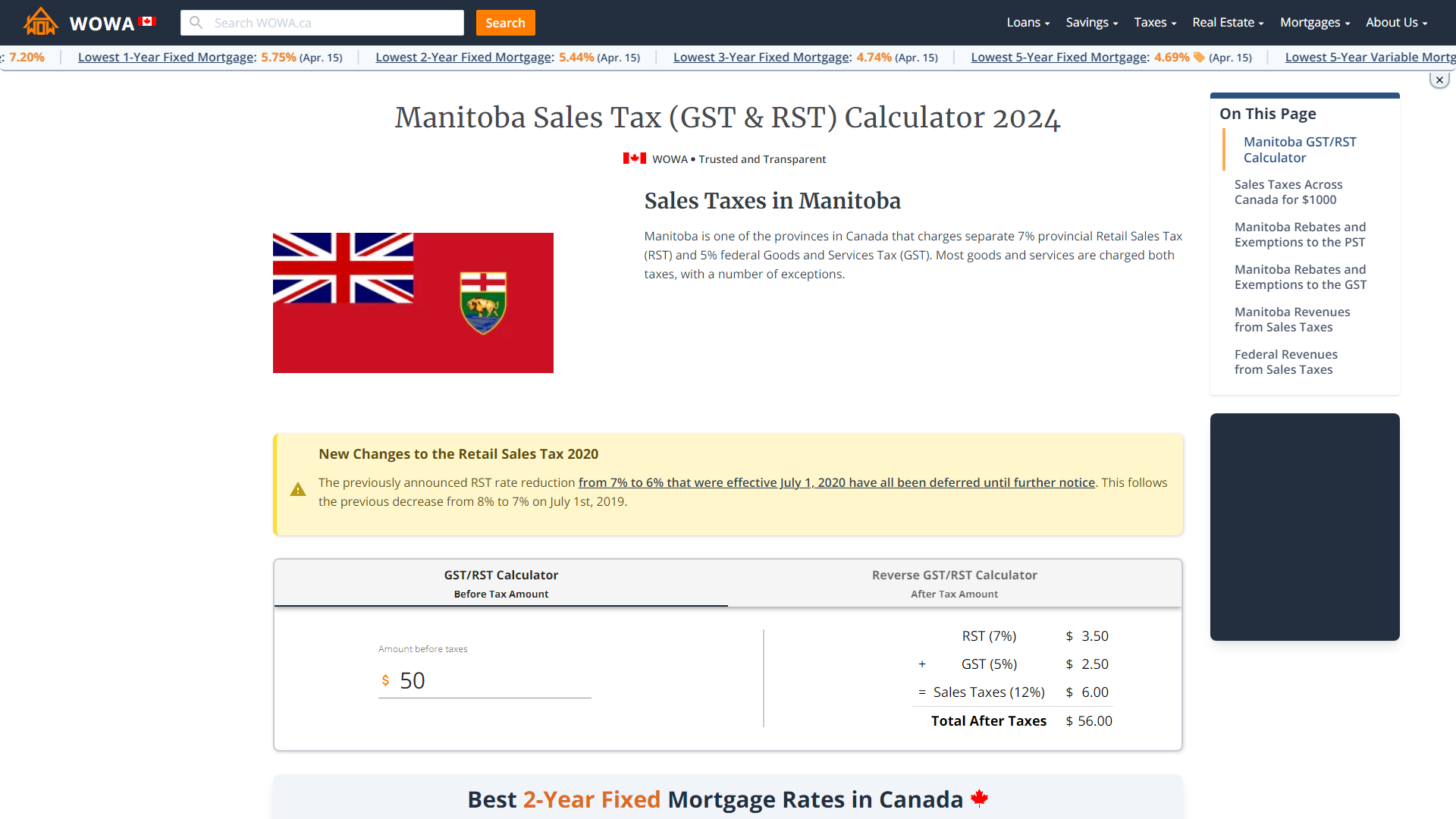

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. This tax calculator is used for income tax estimationPlease use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12.

Type of supply learn about what supplies are taxable or not. - 3 city levy is charged on hotel motel and resort accommodations in Kelowna. You calculate the PST and MRDT on the total purchase price of the accommodation.

GSTHST provincial rates table. A tax rate increase will only take effect after an application has been. Some items such as food and books are exempt this tax.

Calculate property transfer tax for BC including British Columbias Newly Built Homes Exemption calculation. 9 An additional 07 may. On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia.

The Retail Council of Canada has a webpage on the breakdown of sales tax rates by province. BC Provincial Sales Tax Act Section 23 Province-wide in 45 mu-nicipalities and districts Province of BC for transfer to regional districts individual mu-. Income Tax Calculator British Columbia 2021.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. The British Columbia Income Tax Salary Calculator is updated 202223 tax year. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12.

Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all of BCs taxation revenue during the 2019 fiscal year. Only In Your State. Ministry of Finance PO Box 9442 Stn Prov Govt Victoria BC V8W 9V4 Provincial Sales Tax PST Bulletin Accommodation Provincial Sales Tax Act The revision bar identifies changes to the previous version of this bulletin dated November 2014.

This is greater than revenue from BCs corporate income tax and property tax combined. Most transactions of goods or services between businesses are not subject to sales tax. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple annual British Columbia tax calculator or switch to the advanced British Columbia annual tax calculator to.

The British Columbia Annual Tax Calculator is updated for the 202021 tax year. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. 5 Counties must levy a lodging tax of 1 or 2 based on population.

Current GST and PST rate for British-Columbia in 2021. Understand and calculate British Columbias new luxury car tax. Hotel Room Rates and Taxes.

Current GST and PST rate for British-Columbia in 2019. BC Luxury Car Tax Calculator. 21 In this regulation unless the context otherwise requires section 1 of the Act shall apply.

Find out about rebates for first-time home buyers and speculation tax for foreigners. BC Revenues from Sales Taxes. 6 The rate becomes 15 after 712020.

On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia. 1 This regulation may be cited as the Hotel Room Tax Regulation. You calculate the PST and MRDT on the total purchase price of the accommodation.

Alberta for instance has none. Hospitality Tax applies Tourism. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

This is income tax calculator for British Columbia province residents for year 2012-2021. Dealership Private Sale Passenger Non-Passenger calculate price after tax. Not all provinces in Canada have PST.

Easy to Use BC Property Transfer Tax Calculator Enter in your purchase price estimated or actual and select all fields that apply to you in our property transfer tax calculator below. Your hotel is located in Vancouver which is subject to a 3 MRDT and you participate in a. This bylaw shall come into full force and effect and is binding on all persons as of January 1 2014.

The government bulletin PST 310 explains how PST applies to goods that are brought or sent into BC or received in the province. Currently the following tax rates apply.

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property Buyers Home Loans Property Buyers Property For Rent

Calculate Import Duties Taxes To Canada Easyship

Calculator Application For A Private Mortgage Insurance Startup By Extej Design Agency On Dribbble Private Mortgage Insurance Calculator Design Start Up

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

British Columbia Gst Calculator Gstcalculator Ca

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Set Of Color Flat Design Icons By Creative Graphics On Creativework247 Flat Design Icons Icon Design Web Design Icon

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

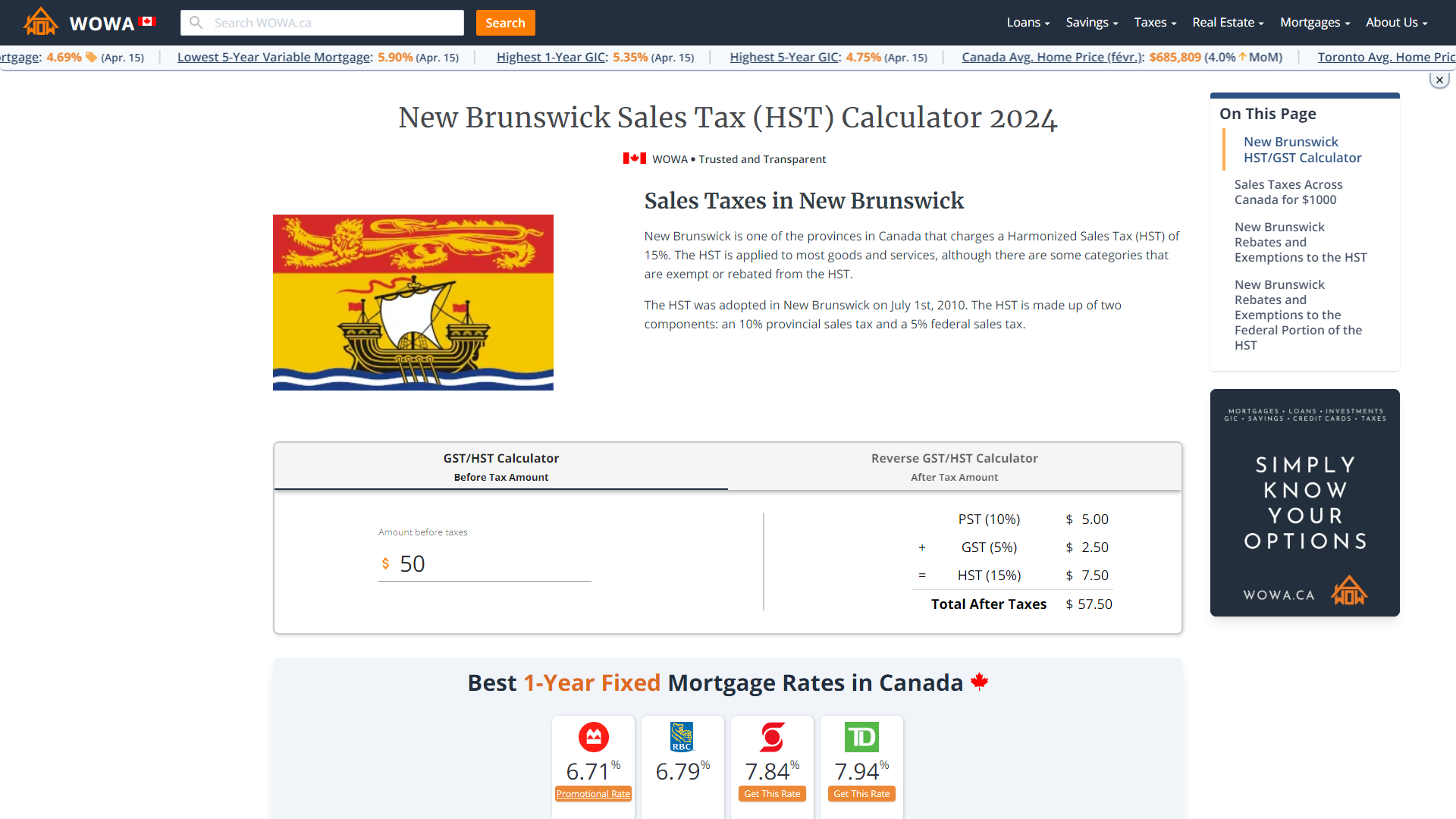

New Brunswick Sales Tax Hst Calculator 2022 Wowa Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

The Independent Contractor Tax Rate Breaking It Down Benzinga

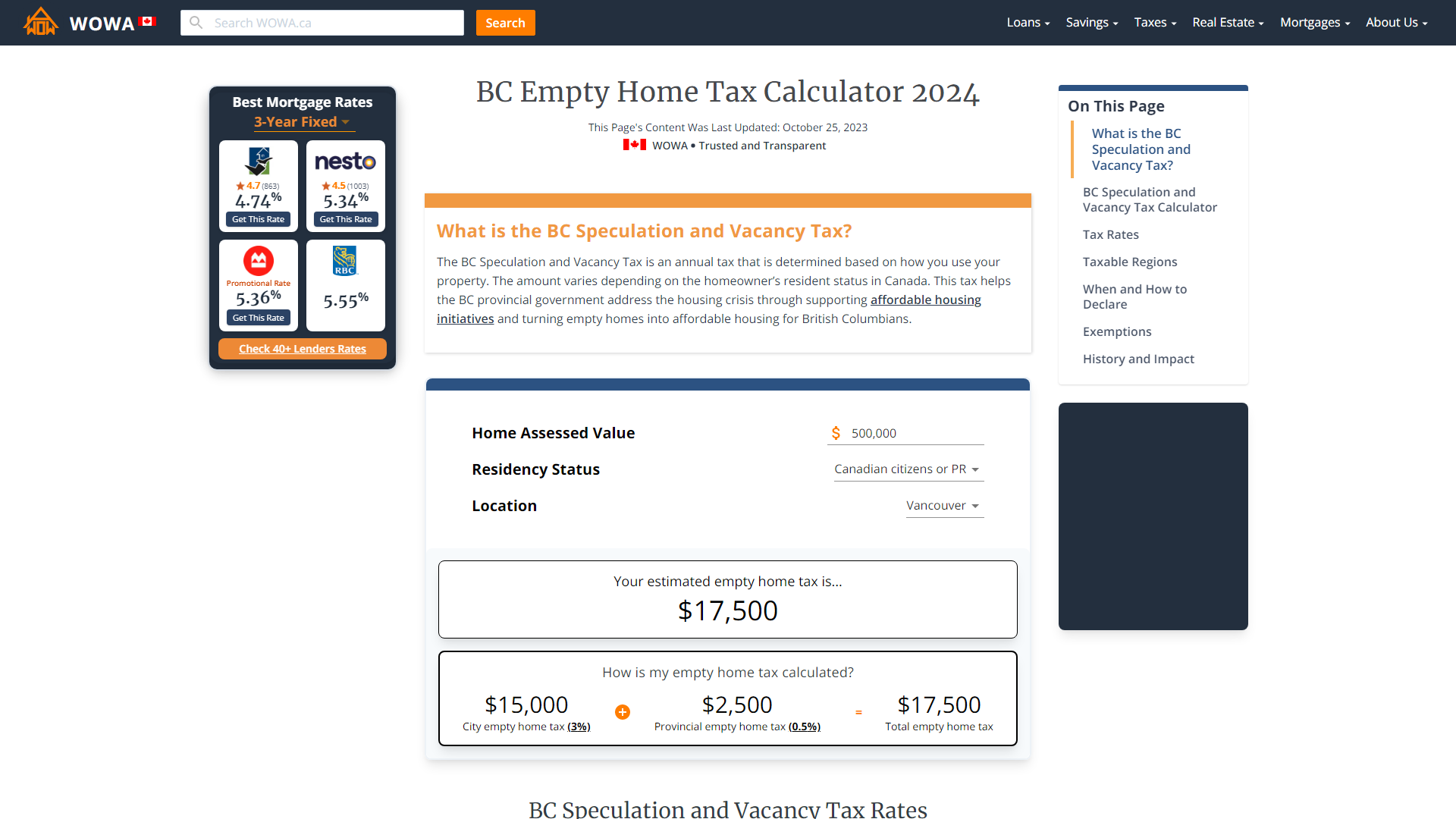

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

Land Transfer Tax In Toronto Ratehub Ca

Land Transfer Tax In Toronto Ratehub Ca

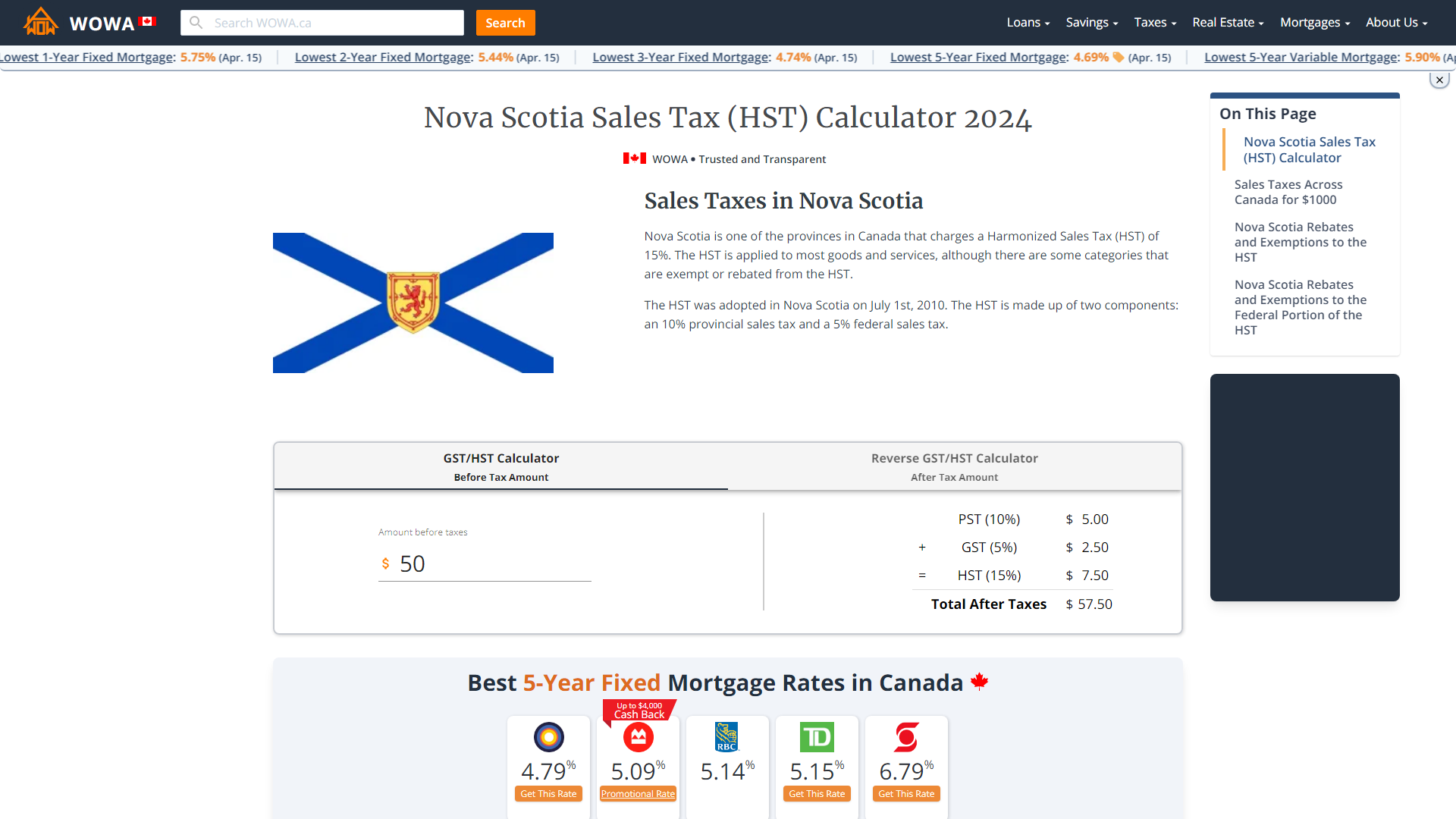

Nova Scotia Sales Tax Hst Calculator 2022 Wowa Ca

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

Income Tax Calculation 2019 इनकम ट क स Calculate करन क सबस आस न तर क 2019 20 Youtube