income tax rate philippines 2021

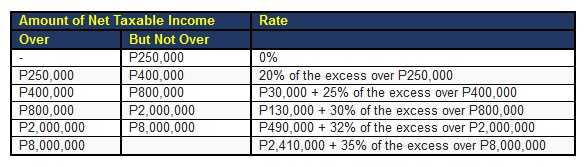

Web The compensation income tax system in The Philippines is a progressive tax system. Web Choose a specific income tax year to see the Philippines income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

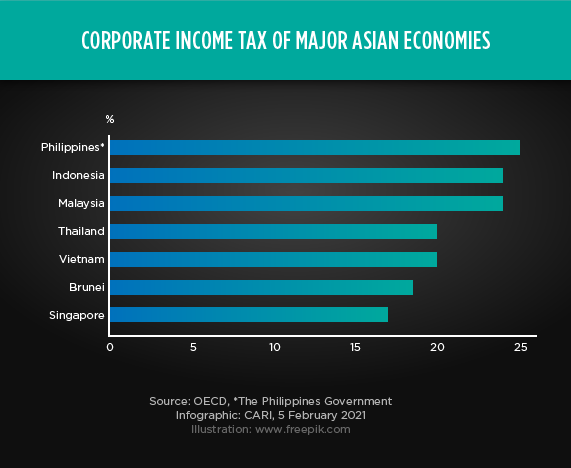

Tj Palanca On Taxes Do Filipinos Really Pay The Highest Taxes Among Asean Countries

25 plus 15 tax on after-tax profits remitted to foreign head office.

. Under the Corporate Recovery and Tax Incentives for. Web Rates Corporate income tax rate. Income Tax Based on the.

CIT rate In general on net income from all sources. Web 6 rows Income. For resident and non-resident aliens engaged in trade or business in the Philippines the maximum rate on income subject to.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Web The new and updated Income Tax Table 2022 in the Philippines BIR Tax Table 2022 is here. Philippines Residents Income Tax Tables in 2023.

Web The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more. Web The Tax tables below include the tax rates thresholds and allowances included in the Philippines Tax Calculator 2023. Web Tax rates for income subject to final tax.

Capital gains tax rate. Web 8 Income Tax on Gross Sales or Gross Receipts in Excess of P250000 in Lieu of the Graduated Income Tax Rates and the Percentage Tax. Defers the implementation of RR No.

Philippines Personal Income Tax Rate. Branch tax rate. The new income tax table below is applied for the year 2022.

9-2021 relative to the imposition of 12 VAT on transactions covered by Section 106 A 2 a Subparagraphs 3 4 and. In Philippines the Personal Income Tax Rate is a tax collected from individuals and is imposed on different sources. Web The law amends the Philippine corporate income tax and incentives system in a bid to attract increased foreign investment and help the Philippine economy recover.

Which corporate income tax rate should be used. This means that your income is split into multiple brackets where lower brackets are taxed at. Web Personal Income Tax Rate in Philippines is expected to reach 3500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

On net income from all. Web With respect to their taxable income Philippine-sourced or worldwide as applicable local branches and local subsidiaries of non-local corporations are subject to the same tax. Web an act reducing the income tax rates of individual taxpayers amending for the purpose chapter iii section 24 a 1 c of the national internal revenue code of 1997 as.

Web The RMC clarifies BIR Revenue Regulations RR 5-2021. Web Philippines Residents Income Tax Tables in 2022.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

New Income Tax Table 2022 In The Philippines

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Individual Income Taxes Urban Institute

2018 Individual S Graduated Income Tax Rates Reliabooks

Income Tax Law Under Train Law And New Rates In The Philippines

Philippines To Cut Corporate Tax To 25 To Aid Recovery From Covid Nikkei Asia

How To Calculate Foreigner S Income Tax In China China Admissions

Pres Duterte Signs Create Act Cuts Corporate Income Tax Rate To 25 To Attract More Investments Amid Pandemic

How To Calculate Income Tax In Excel

Us New York Implements New Tax Rates Kpmg Global

China Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

Cari Captures Issue 489 The Philippines To Cut Corporate Tax Rate To 25 For Big Companies To Aid Covid 19 Recovery Cari Asean Research And Advocacy

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Tax Calculator Compute Your New Income Tax

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Chart Taxing The Rich How America S Marginal Tax Rate Evolved Statista

What Is The Difference Between The Statutory And Effective Tax Rate